What Can’t Be Included in a Business Travel Expense List? In this case, the cab fare is the main expense, and the tip is the incidental expense.

#Small business travel expenses driver

For instance, an employee who takes a cab from the airport to their hotel will pay the fare and also tip the driver if it is customary according to the destination’s etiquette.

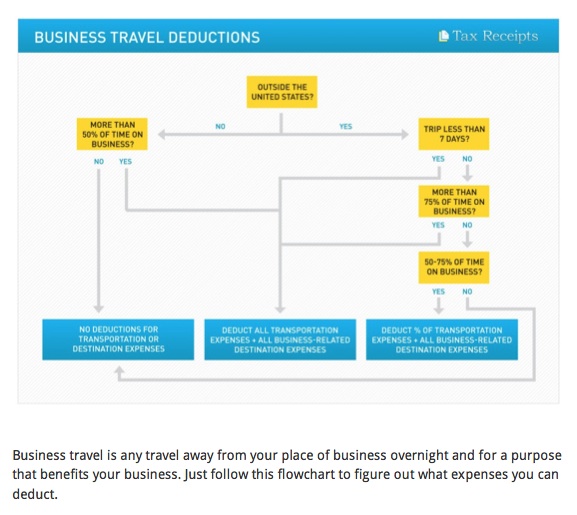

Incidental expenses are minor ancillary fees incurred on top of the main service or item paid for during any business activity. Under this category, employees can claim the expenses they incur on food and drinks they consume during a business trip. It is also known as per diem or meal allowance. Subsistence expenditure is the money employees spend on sustaining themselves while traveling for work. Employees can claim the money they spend on business travel accommodation like hotels, resorts, etc. Accommodation ExpensesĪccommodation expenses are the costs employees incur while making stay arrangements for a business trip. Moreover, if they use their own vehicle for business travel, they can claim reimbursement as per the US Mileage Reimbursement Policy. Employees can claim expenses they incur on flights, trains, taxis, cabs, parking fees, etc. Transportation cost includes all the expenses associated with using or maintaining a vehicle for business travel purposes. In general terms, business travel expenses can be broken into the following categories: 1. If they are not sure if an expense is policy-compliant, they must review the travel expense list in the policy guidelines. In such cases, the employees may mix leisure with business travel, but they should be mindful of the company’s travel and expense policy. However, some companies might also cover Bleisure travel expenses. What Can Be Included in a Business Travel Expense List?Īn expense qualifies as a business or employee travel expense if the traveler has incurred it on a business trip for a work-related objective like a meeting or a seminar. Therefore, for self-paid trips, all employees are expected to create a travel expense list, and preserve the expense receipts to present as proof for reimbursement upon returning to the office.

However, in cases where employees pay for travel expenses, they are reimbursed.

#Small business travel expenses software

Organizations can track and manage such costs by creating travel expense lists using an expense-tracking software solution.Ĭompanies often bear employee travel expenses by booking transportation and accommodation for business trips. It can include the costs of transportation, meals, and accommodation. According to Internal Revenue Service (IRS), employees are considered to be on a business trip if they are traveling away from their primary place of work longer than their ordinary office hours, and need to get sleep to meet the demands of their job while away.Īny expense incurred while making travel arrangements during such a trip is considered a business travel expense. Business travel expense is the cost an employee incurs to accomplish work goals while on a business trip.

0 kommentar(er)

0 kommentar(er)